Introduction

Regional integration has become a global phenomenon of growing relevance. It has become a feature of global political, economic, social, and cultural realities. It is also seen as a viable alternative governance framework in facilitating and promoting peace, security, and the promise of growth and development for a number of geographically linked countries that constitute a regional body. The Association of Southeast Asian Nations (ASEAN) works towards regional integration and prepares the region politically, socially, and economically to realize the ASEAN Community.

ASEAN was founded through the ASEAN Declaration (Bangkok Declaration) in August 1967. Two (2) of its rationales comprise facilitating peace among the countries of Southeast Asia (SEA), and economics evolve integrated economic cooperation among the member-countries. Conceived in November 2003, the fulfillment of the objectives of the ASEAN Community 2020 has been accelerated to be met in 2015. Adopted during the Declaration of ASEAN Concord II (Bali Concord II), the ASEAN community stands on three pillars namely: political- security; economic; and socio-cultural; to ensure lasting peace, political stability, and shared economic prosperity and growth among the member states.

The Building Blocks of AEC

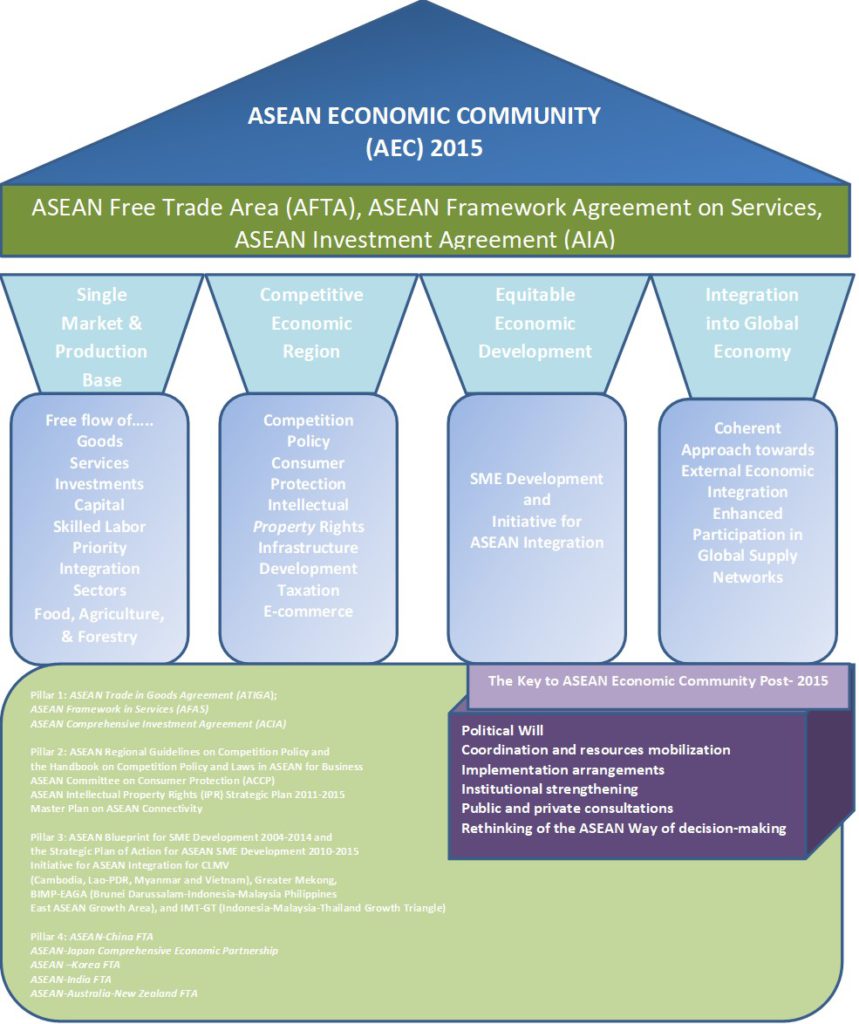

In 2007, the 10 ASEAN Member States took on the goal of forming an integrated economic region and labeled it the ASEAN Economic Community (AEC). One of the basic foundations of AEC is the ASEAN Free Trade Area (AFTA). AFTA is an agreement that requires the ASEAN Member States (AMS) to lower their tariff rates on a wide range of products traded within the region to 0-5%. The agreement commenced with the signing of the Common Effective Preferential Tariff (CEPT) Scheme for AFTA on January 28, 1992 (Hew: 2008). Its basic objectives are: (i) to accelerate regional economic growth by liberalizing trade and abandoning import-substitution industrialization; (ii) to respond to emerging trade blocs around the world such as the North America Free trade Area (NAFTA), the deepening of the European Union (EU), and Asia Pacific Economic Cooperation (APEC); and (iii) to serve as an effective platform to intensify cooperation among the AMS (Abidin: 2012).

The second stalwart is the ASEAN Framework Agreement on Services (AFAS), which aims to enhance cooperation in the services sector by eliminating intra-regional trade restrictions and facilitate the free flow of services by 2015 (Hew:2008:25). AFAS deals with the liberalization of services through successive rounds of negotiations to submitting increasingly higher levels of commitments for priority areas as well as mutual recognition agreements on professional services. Priority areas for liberalization include air transport, e-ASEAN, healthcare, and tourism by 2010, while the professions for mutual recognition agreements (MRAs) include architecture, accountancy, engineering, surveying, nursing, medical and dental practitioners, and tourism (Abidin: 2012).

To supplement AFTA and AFAS in the creation of a single market, ASEAN adopted the ASEAN Investment Agreement (AIA) to expedite the progressive liberalization of investment with a thought in mind of achieving a region with a free and open investment atmosphere and condition. The agreement signed on October 7, 1988, aims to make ASEAN a highly competitive investment area that will attract FDI flows from ASEAN and non-ASEAN investors. Furthermore, it obliges member countries to reduce or eliminate investment barriers and grant national treatment to ASEAN investors by 2010, and to all investors by 2020. The agreement also encourages investors, particularly from ASEAN countries, to adopt a regional investment strategy and promote regional production networks (Hew: 2008). AIA is vital in providing greater scope for division of labor and industrial activities across the region and in creating opportunities for greater industrial efficiency and cost competitiveness. It benefits investors through greater investment access to industries and economic sectors, as well as from more liberal and competitive investment regimes that should reduce the transaction costs of doing business in the region (Hew: 2008).

AEC Blueprint: The Four Pillars of AEC and their Foundations

The basic objective of AEC and its Blueprint is to transform the region into an area with free movement of goods, services, investment, skilled labor, and free flow of capital. In particular, the AEC Blueprint aspires to address equitable economic development, reduction of poverty, and socioeconomic disparities in the region (Hew: 2008). AEC is said to benefit over 625 million people where goods, production of assets, people, and capital are freer to move across the 10 ASEAN Member States (AMS). Its implementation is evidence of ASEAN’s sober ingenuity of turning the region into an inclusive, wide-ranging, and far-reaching single market by 2015 and beyond. It did not only fundamentally laid-out the roadmap of the ASEAN economic integration, but it also epitomized a ground-breaking economic regional development and determined the targets and goals that each ASEAN Member States must focus on and be mindful of under the AEC.

- Single Market and Production Base

The first pillar of AEC focuses on integrating ASEAN’s production network by ensuring that goods, services, investments, capital, and skilled labor are well connected based on the twelve (12) priority integration sectors [efn_note] 12 Priority Integration Sectors, nine (9) pertain to goods and three (3) pertain to services. The 12 PIS include agro-based goods, air transport, automotive products, e-ASEAN, electronics and electrical goods, fisheries, health care services, rubber-based goods, textiles and clothing, tourism, logistics services and wood-based products (ASEAN: 2012) . [/efn_note] (Abidin: 2012). The main focus of the pillar is to provide consumers in the region with an expanded market on the one hand, and the producers an expanded space, to undertake their production activities with less administrative obstructions from countries within the region on the other hand. The foundations of this pillar include (i) the ASEAN Trade in Goods Agreement (ATIGA) [efn_note]In the 14th Summit, ASEAN leaders decided to further consolidate the integration process by signing a new ASEAN Trade in Goods Agreement that superseded AFTA’s agreement on the Common Effective Preferential Tariff – ASEAN Free Trade Area (CEPT-AFTA). Various chapters of this agreement discuss Technical Barriers to Trade, Sanitary and Phytosanitary, Temporary Modification and Suspension of Concessions were included to ensure consistency with key principles of the Trade in Goods Agreements with ASEAN’s Dialogue Partners (Abidin: 2012).[/efn_note]; (ii) the ASEAN Framework in Services (AFAS); and (iii) the ASEAN Comprehensive Investment Agreement (ACIA)[efn_note]The ASEAN Comprehensive Investment Agreement (ACIA) was signed in pursuit of which investment liberalization will be progressive and have clear timelines. With limited exceptions, national treatment and most favored-nation (MFN) treatment will be extended to ASEAN investors before and after the establishment of their firms (Abidin: 2012).[/efn_note] (Abidin: 2012).

- A Highly Competitive Economic Region

This pillar aims to create a competitive economic region with a set of common rules (such as the prohibition of cartels and abuse of government subsidies) to avoid abuse and discrimination as a result of an integrated region by promoting fair competition policy, consumer protection, intellectual property rights, infrastructure development, tax reform and e-commerce (Abidin: 2012). This pillar is founded on the following: (i) the ASEAN Regional Guidelines on Competition Policy and the Handbook on Competition Policy and Laws in ASEAN for Business;[efn_note]The ASEAN Regional Guidelines on Competition Policy and the Handbook on Competition Policy and Laws in ASEAN for Business were launched to promote healthy competition and fair business practices in the region. The Guidelines provide a good reference on country experiences and best practices at the international level, while the Handbook provides basic notions of substantive and procedural competition law applicable in the ASEAN Member States (ASEAN: 2012).[/efn_note] (ii) the ASEAN Committee on Consumer Protection (ACCP)[efn_note]In line with the mandate of the newly established ASEAN Committee on Consumer Protection (ACCP), ASEAN endorsed the Guidelines for Notification and Information Exchange on Recalled/Banned Products in October 2011. ACCP initially develop the “Cross Border Redress Website” that will serve as the main reference point for matters pertaining to consumer redress. Dissemination of the ASEAN Consumer Complaints leaflet is being developed to increase awareness of visitors/tourists on the rights of consumers in ASEAN (ASEAN: 2012).[/efn_note]; (iii) the ASEAN Intellectual Property Rights (IPR) Strategic Plan 2011-2015[efn_note]The development of intellectual property (IP) and IP rights (IPRs) is crucial to build an innovative and competitive economic region. As such ASEAN has strengthened the IP institution and carried out new initiatives. In August 2011, the ASEAN IPR Action Plan 2011-2015 was endorsed (ASEAN: 2012).[/efn_note]; (iv) and the Master Plan on ASEAN Connectivity [efn_note]The Master Plan on ASEAN Connectivity is both a strategic document for achieving overall ASEAN Connectivity and a plan of action for immediate implementation for the period 2011-2015 to connect ASEAN through enhanced physical infrastructure development (physical connectivity), effective institutions, mechanisms and processes (institutional connectivity) and empowered people (people-to-people connectivity). The three-pronged strategy will be supported by the required financial sources and coordinated institutional mechanisms. The Master Plan also ensures the synchronization of ongoing sectoral strategies and plans within the frameworks of ASEAN and its sub-regions. Through an enhanced ASEAN Connectivity, the production and distribution networks in the ASEAN region will be deepened, widened, and become more entrenched in the East Asia and global economy (ASEAN: 2012).[/efn_note](Abdin:2012).

- A Region of Equitable Economic Development

This pillar intends to bridge the human development and economic gaps within the ASEAN region through small and medium enterprises (SMEs) development and the Initiative for ASEAN Integration (IAI) (Abidin: 2012). Among the foundations of this pillar are: (i) ASEAN Blueprint for SME Development 2004-2014 and the Strategic Plan of Action for ASEAN SME Development 2010-2015;[efn_note]To further enhance the competitiveness and resilience of SMEs toward a single market and production base, ASEAN implemented the Strategic Action Plan for the ASEAN SME Development (2010-2015). Endorsed in August 2010, the Plan gives guidance on the current flagship projects and other SMEs initiatives in the region (ASEAN: 2012). [/efn_note] and (ii) the Initiative for ASEAN Integration for CLMV (Cambodia, Lao-PDR, Myanmar and Vietnam), Greater Mekong, BIMP-EAGA (Brunei Darussalam-Indonesia-Malaysia Philippines East ASEAN Growth Area), and IMT-GT (Indonesia-Malaysia-Thailand Growth Triangle) [efn_note]The Initiative for ASEAN Integration have been created to facilitate the narrowing of development gaps, the development of new modalities and approaches explored to ensure that the benefits of the AEC trickle down to the smaller ASEAN economies (Cambodia, Lao PDR, Myanmar and Viet Nam or CLMV) and sub-regions (such as the Brunei Darussalam-Indonesia-Malaysia-Philippines East ASEAN Growth Area and Indonesia-Malaysia-Thailand Growth Triangle (IMT-GT) (ASEAN: 2012).[/efn_note] (ASEAN: 2012).

- A Region that is Fully Integrated into the Global Economy

This pillar is ASEAN’s initiative to integrate the region with the world by establishing free trade agreements (FTAs) with key economies and regions. Most of these FTAs are expanded to become cooperative partnerships that go beyond liberalization, hence include cooperation measures to help ASEAN strengthen its productive capacity. These agreements have extensive coverage including trade in goods and services, investments, intellectual property rights, and health standards. So far, ASEAN countries have established many FTAs both through individual bilateral agreements and as a group (Abidin: 2012). Among the key ASEAN based FTAs are; (i) ASEAN-China FTA; (ii) ASEAN-Japan Comprehensive Economic Partnership; (iii) ASEAN –Korea FTA; (iv) ASEAN-India FTA; and (v) ASEAN-Australia-New Zealand FTA (ASEAN: 2012) (ASEAN: 2012).

Progress and Achievements

The ASEAN Integration Report 2015 and A Blueprint for Growth-ASEAN Economic Community 2015: Progress and Achievements articulated that 92.7%, 469 of 506 High Priority Measures (HPMs) in AEC Blueprint were significantly implemented across the four pillars in all sectors.

For the first pillar, remarkable progress has been noted by the average ATIGA rate for all AMS standing only at 0.54% in 2014, compared with the Most Favored Nation (MFN) average of 6.90%. The shares of ATIGA tariff lines at ATIGA 0% stand at 99.2% for the ASEAN-6 [efn_note]ASEAN-6 consists of Brunei Darussalam, Indonesia, Malaysia, the Philippines, Thailand and Singapore.[/efn_note] and 72.6% for the CLMV[efn_note]CLMV consists of Cambodia, Lao PDR, Myanmar and Viet Nam.[/efn_note] in 2014, and the latter is expected to increase to 90.8% in 2015 (ASEAN: 2015). These developments have promoted greater and more intra-trade in manufacturing and agricultural goods (ASEAN: 2015).

On the movement of professionals, though still relatively slow, progress has been made with the signing of Mutual Recognition Agreements (MRAs). A total of eight MRAs have been concluded, namely on engineering services, nursing services, architectural services, a framework for surveying qualifications, medical practitioners, dental practitioners, the framework for accounting services, and tourism professionals (ASEAN: 2015). However, there is a need to push for expeditious implementation of the ASEAN MRAs according to the provisions of each respective MRA, and the identification and development of MRAs for other professional services. All these could only be realized through legal transposition and effective implementation.

In terms of intra-regional trade, ASEAN progressed modestly. In 2014, it was 58.9% higher than in 2007, marginally above the growth in extra-regional trade of 51.7%. In terms of share of total trade, intra-ASEAN trade remained constant at 24.1% in 2014, but still higher compared to the share of China, ASEAN’s largest external trade partner. The services sector on the other hand now accounts for the largest share of the region’s economy and equally is the biggest recipient of FDI inflows (ASEAN: 2015).

In terms of FDI, ASEAN had progressed in becoming a single investment destination. ASEAN is now one of the key destinations for FDI, as shown by the steady increase in total FDI inflows into the region, which reached US$136.2 billion in 2014. Intra-ASEAN FDI stands at 17.9% in 2014 compared with just 11.3% when the AEC Blueprint was first adopted as well (ASEAN: 2015).

Diffident accomplishments are also visible in the second and third pillars of AEC and these mostly pertain to infrastructure development like the ASEAN Highway Network for land transport, adoption of the Integrated and Competitive Maritime Transport for maritime co-operation, which sets a framework for the progressive development of integrated ASEAN ports and shipping sectors, and the implementation of the ASEAN open skies policy as part of the ASEAN Single Aviation Market which opened competitive space for expansion and opportunities for regional air travel for the aviation sector. Also, the ASEAN Plan of Action for Energy Co-operation that aims to increase renewable energy targets by 15% was adopted (ASEAN: 2015).

While business enabling frameworks in the region are being strengthened, substantial progress has been made in the areas of competition policy, consumer protection, and intellectual property rights. To date, 8 AMS have put in place competition law, and 1 has a consumer protection law in place. Also, ASEAN adopted the ASEAN Benchmark for SME Credit Rating Methodology, the SME Service Centre, the ASEAN SME Policy Index, and the ASEAN Common Curriculum for Entrepreneurship, and these represent a significant boost for SMEs in ASEAN (ASEAN: 2015).

The implementation of the fourth pillar has satisfactorily progressed as well. Economic linkages with external partners through free trade and comprehensive economic partnership agreements (FTAs and CEPAs) were forged. ASEAN as of the moment is a signatory to five FTAs/CEPAs with China, the Republic of Korea, Japan, India, Australia, and New Zealand, respectively. In addition to these FTAs/CEPAs, ASEAN together with its six FTA Partners is currently negotiating the Regional Comprehensive Economic Partnership (RCEP), which is expected to bring significant improvements over existing ASEAN+1 FTAs. RCEP provides a platform for ASEAN to assert its centrality and cultivate its leadership role in the emerging regional architecture (ASEAN: 2015)

Challenges and AEC Beyond 2015

Despite the significant and positive achievements of the AEC under its four pillars, the fact remains that there is still this challenging 7.3% of the high priority measures that need to be fulfilled for the AEC Blueprint to be complete. The realization of these remaining key measures is now being carried out under the Post -2015 AEC Agenda. This requires more effort, support, and commitment both at the national and regional levels. At the state level, there is a need to better engage the entire government (national and sub-national levels). This will help develop broader constituencies for ASEAN’s work and open up more opportunities for businesses and for the ASEAN peoples to take advantage of the opportunities being generated by AEC. (Pedrosa: 2008). Likewise, there is a need to strengthen institutional structures. At the moment, ASEAN still maintains very loose institutional structures and does not operate on the principle of using a formal, detailed, and binding, institutional structures to prepare, enact, coordinate, and execute policies for economic integration (Hew: 2008). Most of all, AMS must rethink the “ASEAN Way” of making decisions –“discussion and consultation”; and “unanimous decision and consensus” if it’s wants to progress further in achieving the remaining goals of AEC. It needs to address also the recurrent hurdle to successful economic integration and that’s AMS “Lack of Political Will to make a realization out of the bold vision set out for the region economically, politically, and socio-culturally.

Conclusion:

The AEC project has been crucial in making ASEAN one of the most dynamic regional economic blocs in the developing world. Since the implementation of the AEC Blueprint in 2007, the overall structure of ASEAN economies has changed. The region experienced unprecedented growth because of an increasing share of foreign direct investments (FDIs) flows, and solid performance of the trade sector, which contributed to the expansion of the region’s output. Even though there remains still this challenging 7.3% of HPMs that need to be completed, there is no denying that 2015 for AEC is a milestone year, – a measure of work in progress rather than a hard target (Severino: 2013).

Looking at the prospects of AEC beyond 2015, there is no doubt that the benefits and the potentials of ASEAN’s economic integration will continue to contribute to the economic resilience and growth performance of the region. The macroeconomic landscape of ASEAN will continue to transform while challenging global economic conditions. Thus, AEC as a project remains a work in progress that is there on the horizon to unfold in the foreseeable future.

References

Abidin, M.Z. 20012. “Mainstreaming Human Security in the ASEAN Economic Community” in

the Mainstreaming Human Security in ASEAN Integration: Human Security and the

Blueprints for Realizing the ASEAN Community edited by Carolina Hernandez and Herman

Joseph Kraft. Manila, Philippines: Institute for Strategic and Development Studies (ISDS)

Hew, D. 2008. “Towards an ASEAN Economic Community by 2015” in The ASEAN

Community: Unblocking the Roadblocks. Singapore: ISEAS

Pedrosa, E. 2008. “Towards An ASEAN Economic Community: Matching the Hardware with the Operating System” in The ASEAN Community: Unblocking the Roadblocks. Singapore: ISEAS

Soesastro, H. 2008. “Implementing the ASEAN Economic Blueprint” in The ASEAN

Community: Unblocking the Roadblocks. Singapore: ISEAS

Tongzon, J.L.2005. “Role of AFTA in an ASEAN Economic Community” in Roadmap to an ASEAN Economic Community edited by Denis Hew. Singapore:ISEAS